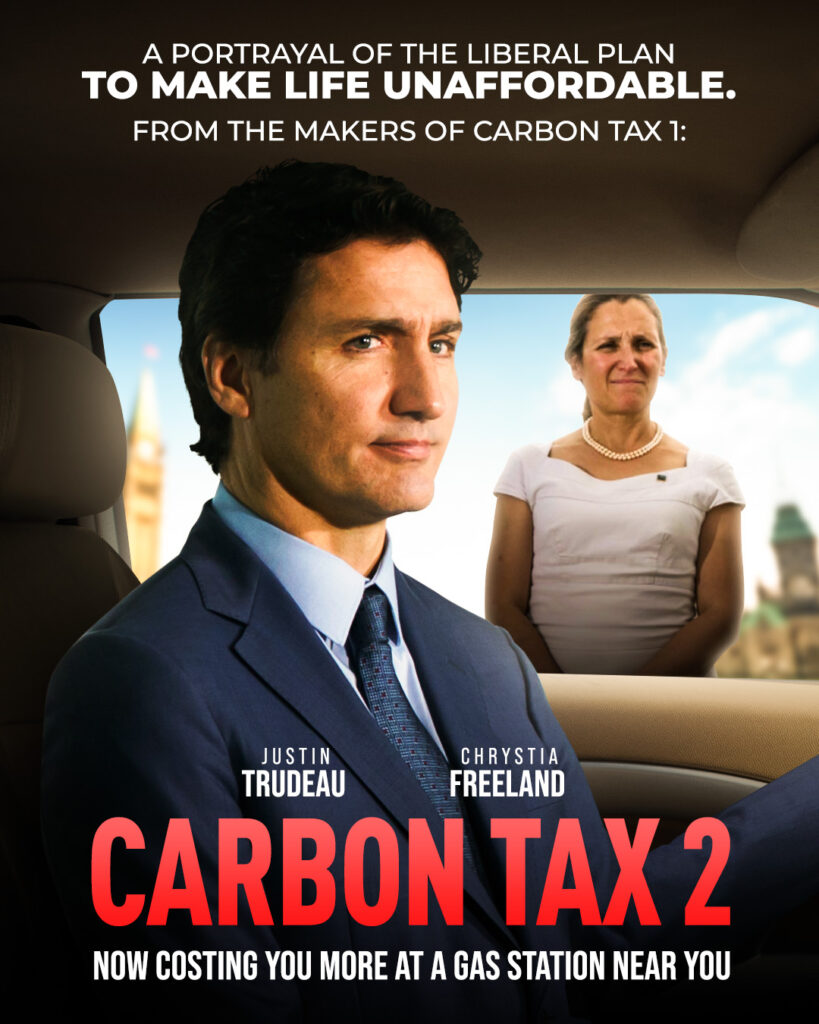

MP Report: Trudeau’s Carbon Tax Quagmire, Draining Prosperity, Drowning Innovation

As Canada celebrated its 156th birthday on July 1st, Prime Minister Justin Trudeau presented a controversial gift to Canadians: a second carbon tax. Disguised within fuel regulations, this new carbon tax comes on top of the existing one, with no rebates for consumers. Trudeau’s promise of a greener future is now turning into a nightmare for certain provinces, especially Alberta and Saskatchewan.

The mechanics of the second carbon tax are simple but devastating. Fuel producers are mandated to reduce carbon content in their products. If they fail to meet these stringent requirements, they are compelled to buy credits, and these costs are inevitably passed on to consumers through higher pump prices. There are no rebates to ease the blow of this tax, unlike the first carbon tax. It’s a relentless burden that continues to pile up.

The impact on families and businesses in Alberta and Saskatchewan is alarming. The Parliamentary Budget Officer (PBO) predicts that by 2030, the second carbon tax will add around 17 cents per liter to the cost of gasoline and 16 cents per liter to diesel. Families will be hit hard, with an average of $1,157 extra per year for Albertans and about $1,117 for households in Saskatchewan due to the second carbon tax alone. Over the course of seven years, the combined burden of Trudeau’s carbon taxes will cost average Alberta families nearly $4,000 and Saskatchewan families approximately $2,840 more annually.

What makes this situation all the more unfair is that families in Alberta and Saskatchewan are being hit harder than those in other provinces due to their unique geographical and economic circumstances. With harsh winters and long distances between cities, these provinces rely heavily on fossil fuels for survival and transportation. Additionally, their economies are closely tied to the production of fuels that sustain the rest of the nation. As a result, the average prairie family will bear an extra cost of approximately $500 compared to families in other provinces.

Despite these crippling taxes, there is a growing realization that Canada’s emissions are relatively insignificant on a global scale. Accounting for only 1.5% of worldwide emissions, our efforts to combat climate change through carbon taxes are unlikely to yield significant results. More than three-quarters of countries globally do not even have a national carbon tax, placing Canada at a disadvantage with its dual taxation approach.

Moreover, the impact of these carbon taxes extends beyond families and businesses. Canada’s economic growth is stifled, with business investments witnessing a decline compared to the United States, which has experienced significant gains. Trudeau’s climate policies have failed to achieve emission targets and have hindered the growth of the energy industry, depriving it of its potential to drive economic prosperity.

Statistics Canada’s former chief economic analyst, Philip Cross, warns that the government’s anti-growth policies are stifling economic development and creating social and political divisions. The Organization for Economic Co-operation and Development predicts Canada’s per capita GDP growth will be the lowest among its member nations without fundamental changes in the government’s approach to growth.

To add insult to injury, Trudeau’s push for net-zero emissions by 2035 is driving up power bills and undermining energy independence. Demanding a 42% reduction in emissions from the oil and gas sector in seven years is forcing hasty and expensive changes that will hurt the economy, increase reliance on foreign oil, and drive-up energy prices even more.

The time has come to reassess our carbon tax policies and find a more balanced approach that fosters environmental sustainability without jeopardizing economic growth. My Conservative colleagues and I believe in technological advancements rather than punitive taxes. It’s time to reject Trudeau’s carbon tax obsession, which only burdens Canadians and does little to address global emissions. Conservatives will axe these taxes and pursue innovative solutions that protect our environment without jeopardizing our economy and affordability.

Canada can lead the global charge towards innovation and prosperity without overburdening its citizens with excessive taxes. Canada’s future lies in striking a balance between environmental responsibility and economic prosperity. We can achieve both by promoting innovation, supporting our energy sector responsibly, and finding real solutions instead of drowning in punitive taxes. Let us not sacrifice our nation’s future on the altar of misguided policies!